Markets

Global Markets in Crisis The Uncertainty of the Bond Market

This week, global markets have experienced significant volatility, particularly following President Trump’s statements on tariffs. As investors face economic uncertainties, the U.S. Treasury bond market has garnered much of the attention.

Trump’s Decision on Tariffs

Throughout the week, Trump wavered between various tariff measures. In the last hours, he announced a 125% increase in tariffs on China, while suspending tariffs on other countries for 90 days. This decision has left the markets with more questions than answers.

The Impact on the Bond Market

U.S. Treasury bonds are traditionally considered a safe haven during times of financial uncertainty. However, amid this turbulent scenario, investors began selling these bonds, affecting their yield and generating large fluctuations.

Highest Yields Since the Pandemic

Long-term U.S. Treasury bond yields have risen significantly, reaching levels not seen since the beginning of the pandemic. This increase in yields is directly impacting interest rates on various financial products.

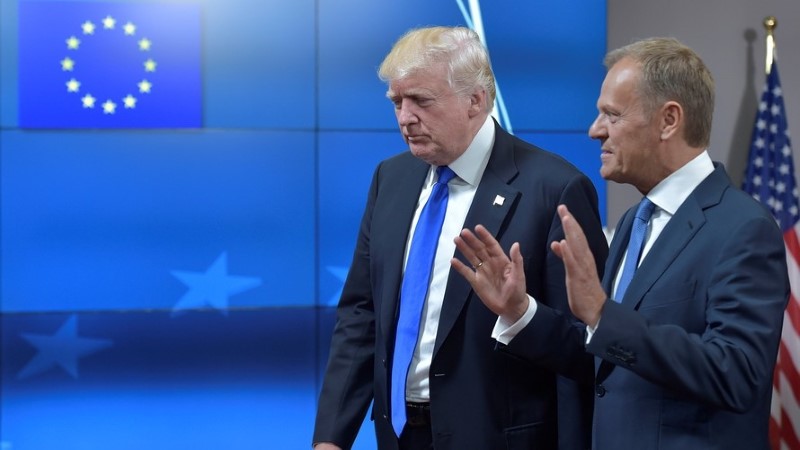

EU and US Begin Trade Negotiations Amid Rising Tensions

The EU and US have started talks on potential solutions to the trade dispute triggered by US President Donald Trump…

Implications for Mortgage Rates and Student Loans

The high yields on Treasury bonds could lead to an increase in mortgage rates and student loans, which would affect millions of Americans. Analysts are concerned about how these changes might influence families’ borrowing capacity.

Bond Auction: A Sign of Relief?

Today, the results of the Treasury bond auction revealed strong demand for 10-year debt, which could provide some stability to the market. This breather may indicate that the situation is not as severe as initially feared.

Trump’s Speech: Expectation of New Revelations

President Trump is scheduled to give a speech this afternoon outside the White House. The market will be closely watching for any new measures that could further affect bond fluctuations and other financial assets.

Volatility Continues

As events continue to unfold, global markets remain in a state of uncertainty. Investors will be attentive to the decisions made in the coming days as they search for clear signals on the U.S. economic direction.